Zcash (ZEC) is a cryptocurrency designed for privacy, letting users control who can see their financial details. It uses zero-knowledge cryptography, so transactions are verified without revealing sensitive information.

In this article, we explore what Zcash is, how it works, and what sets it apart from other crypto.

What Is Zcash (ZEC)?

ZEC enables confidential transactions on the Zcash network through zero-knowledge proofs. This coin offers similar decentralization and transparency features to Bitcoin, with added powerful privacy and anonymity.

What Makes Zcash a Unique Privacy Coin

Zcash differs from other cryptocurrencies due to its use of the zk-SNARKs cryptographic method, which allows nodes to encrypt transaction data, verify its validity, and hide the sender, receiver, and payment amount. While Bitcoin transactions are public by default, Zcash allows users to choose between transparent and shielded payments.

Key Features of the ZEC Token

Here're some key Zcash features:

Private transactions: The ZEC token offers private transactions, enabling users to make payment data publicly visible, choose who to display it to, or hide all completely.

Low fees: Zcash charges low fees, making it suitable for regular and frequent payments or worldwide transfers.

High-level privacy: The protocol ensures strong confidentiality while maintaining a fast transaction confirmation time.

How Zcash Differs From Other Privacy Coins

We have already touched on how ZEC stands out in the cryptocurrency market, but let's discuss it in more detail.

Most of the coins provide privacy by default. But Zcash offers additional confidentiality while allowing regulation. The cryptographic token system does not require interaction between the parties, minimizing computational costs, which in turn increases efficiency.

Thus, the combination of security similar to Bitcoin and flexible privacy settings makes ZEC a balance of privacy and usability.

The History and Development of Zcash

Zcash emerged as a project aimed to improve transaction privacy while preserving the verification advantages of a public blockchain.

Origins of Zcash and Its Founders

Zcash was launched in 2016 as a fork of Bitcoin, led by cryptographer Zooko Wilcox and developed by Electric Coin Company. The token is based on research into zero-knowledge proofs by an academic global team. Later, the Zcash Foundation, a non-profit organization, was created to support decentralization, community management, and open-source development.

Major Network Upgrades and Protocol Changes

ZEC has undergone several technical upgrades. One of them was Sapling and Halo, which consisted of the following:

Sapling lowered the computational cost of shielded transactions

Halo implemented recursive proofs.

Such updates have affected the network's performance, scalability, and privacy.

Zcash Ecosystem Growth and Adoption Milestones

Over time, Zcash expanded through:

Placements on exchanges;

Wallet integrations;

Institutional partnerships.

ZEC's privacy tech has influenced broader cryptographic research and is still being implemented in sectors that require secure, confidential transactions.

How to Use Zcash

Zcash is a convenient and flexible currency, but it's important to understand how to use it.

Main Ways to Use Zcash in 2025 (payments, privacy tools, transfers)

As we've already noted, ZEC is commonly used for private transactions and cross-border transfers. It's widely used by both individuals and businesses, when it's necessary to hide transfer amount, recipient details or any other information that needs to be privately kept.

Zcash Wallet Options: How to Choose a Secure Wallet

A secure Zcash wallet should:

supportboth t-addresses (transparent addresses) and z-addresses;

offer high-level encryption;

allow full control of private keys.

Also, keep in mind that the highest level of security is provided by hardware and well-maintained open-source wallets.

How to Send and Receive ZEC Using a Zcash Address

ZEC transfers are proceeded in almost the same way as any other transfer. Here're how it occurs:

Choose transparent or shielded address;

Confirm the fee;

Broadcast the transaction.

If you've chosen a shielded transfer, the sender, receiver and amount will remain private.

Storing ZEC Safely: Best Practices for Wallet Security

Although ZEC wallets offer high security, do not forget to follow some practices to avoid vulnerabilities. Here are some advices:

Keep seed phases offline;

Use hardware wallers for long-terms holdings;

Enable additional security layers, i.e. pin-codes or two-factor authentication;

Keep wallet software updated.

By following these tips, you'll provide additional protection to your wallet.

Zcash Price and Market Performance

One of the main roles in the popularity of cryptocurrencies is played by their prices. Below we'll explore the basics of ZEC value on the crypto market.

Factors That Influence the Zcash Price

Zcash price, like any other crypto value, depends on several factors and metrics. Let’s take a closer look at the main ones that influenced ZEC price increase in the period from September to November:

Technical upgrades

The improvement of private pools and recursive proofs increase the applicability and trust of storage, which shows the market that the coin is backed by technological progress, which in turn increases demand.

Adoption level and infrastructure

ZEC's liquidity on key platforms has deepened due to improved wallet support and analytics tools for shielded addresses as well as accurate integration of private transactions by decentralized services.

Overall crypto market trends

There has also been sustained growth in interest toward privacy-focused coins. Additionally, institutional investors showed heightened interest following the news that Grayscale Zcash Trust announced a private placement of capital among accredited investors.

Supply dynamics and monetary policies, such as programmed halvings, also have an impact on long-term valuation.

ZEC liquidity across exchanges makes it more widely accessible to global traders.

ZEC Market Trends Compared to Other Crypto Assets

Compared to other major assets, ZEC is more sensitive to regulatory news because of its privacy features. Its market cap remains stable, with price action frequently aligning with broader cycles in the privacy-coin market.

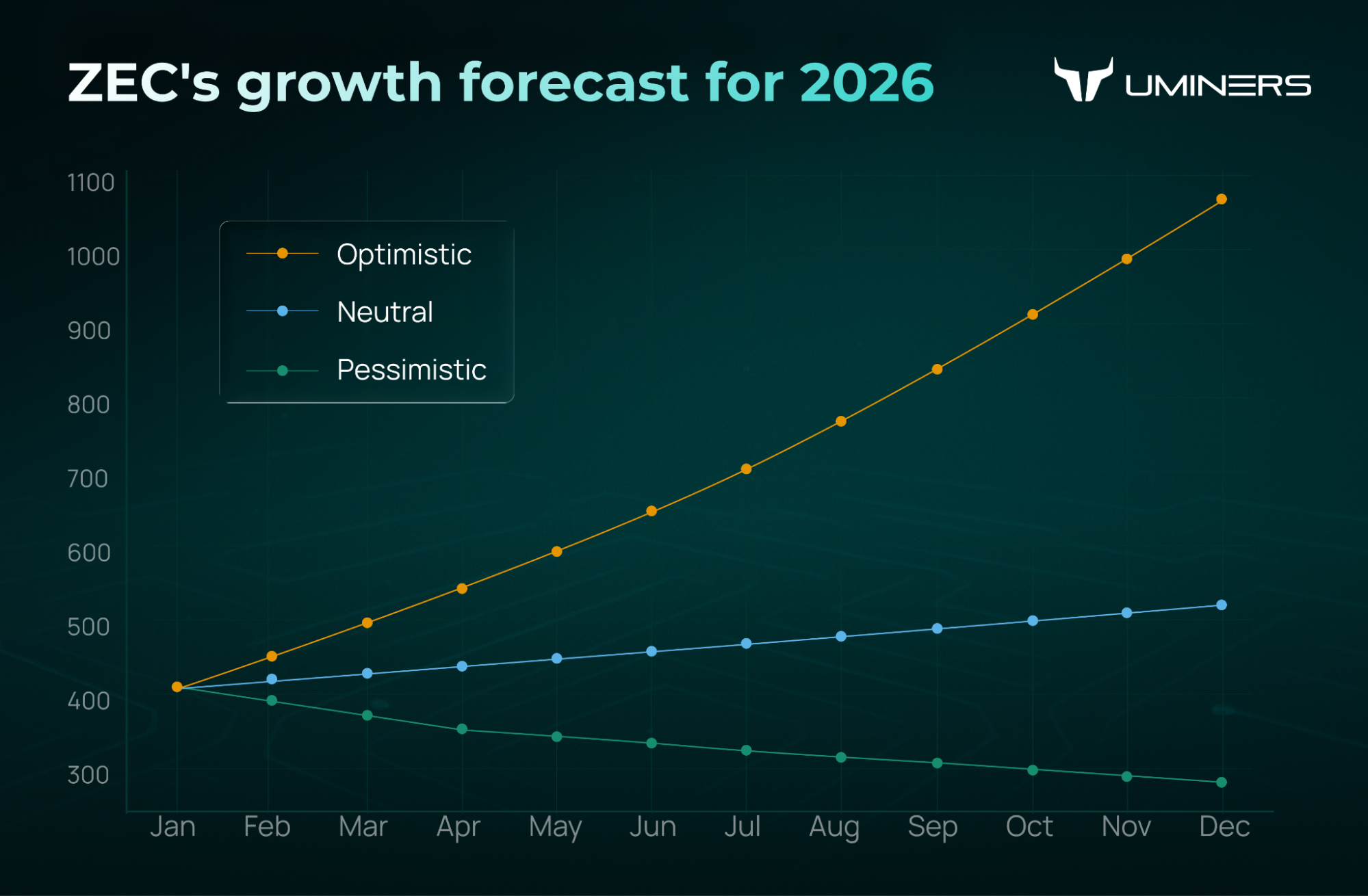

Long-Term Outlook for the Zcash Price

At the moment, demand for confidential digital payments is growing, and ZEC is strengthening its market position.

Many analysts predict that Zcash will continue to grow under current market conditions. Nevertheless, after such a sharp rise, a correction is possible, especially if regulatory risks intensify.

However, most experts agree that if the project maintains its pace of updates and continues integrating into the DeFi ecosystem, it can retain its current position and remain one of the key players in the next market cycle.

Zcash Mining, Staking, and Network Participation

Zcash mining allows users to contribute to network security and decentralization. Let's explore it in more detail.

How Zcash Mining Works Today

Zcash uses a proof-of-work model, a consensus mechanism in crypto used to verify transactions and add new blocks to the blockchain. The network is based on the Equihash mining algorithm, originally optimized to be memory-intensive and resistant to GPU mining. So, today efficient ZEC mining is almost exclusively on specialized ASIC-miners, such as Antminer Z15 Pro.

These ASICs solve computational puzzles, and the miner who adds a new block to the Zcash blockchain receives a reward, contributing to the controlled issuance of coins within the maximum fixed supply of 21 million ZEC.

Most participants mining through pools as their payout schemes, such as PPS+ or FFPS, offer more consistent, predictable earnings compared to solo mining.

Will Zcash Introduce Staking?

Zcash has discussed transitioning from PoW to a proof-of-stake model, another consensus mechanism that uses staking instead of energy-intensive mining to confirm transactions and add blocks to the blockchain.

If this model is implemented, staking could become a new investment and trading opportunity for ZEC holders.

But at the moment there is no information about switching to PoS.

Running a Zcash Node: Benefits and Requirements

Operating a Zcash node offers several advantages but also requires meeting specific conditions. The main benefits and requirements are outlined below.

Advantages:

Public blockchain support

A full node helps maintain the Zcash blockchain by independently validating blocks and transactions.

Transactions confirmation and verification

Nodes verify transaction validity and help propagate them across the network.

Improving network security and resilience

More nodes make the network more decentralized and less dependent on outside services.

Requirements:

Stable internet connection

Needed for continuous synchronization with the network.

Sufficient storage

Zcash’s blockchain grows over time, so you need enough disk space for the whole chain.

Ability to maintain a full copy of the blockchain

Full nodes store the whole blockchain and handle all network data.

Running a Zcash node doesn't earn rewards. It is a voluntary way to support the network, not a profitability mechanism.

How to Buy and Sell Zcash (ZEC)

Like other cryptocurrencies, you can buy, trade, and store ZEC using platforms and secure wallets.

Where to Buy ZEC: Exchanges and Platforms

Zcash is available on exchanges offering ZEC trading pairs, such as Binance, Coinbase, Kraken, and KuCoin. Platforms like Changelly and SimpleSwap also allow users to exchange other cryptocurrencies for ZEC.

Before deciding where to buy Zcash, compare fees, payment methods, and liquidity, as these metrics can affect the purchase experience.

Storing Purchased ZEC in a Crypto Wallet

After you buy ZEC, it is best to move it to a secure wallet, such as a hardware wallet like Ledger. Hardware wallets keep your private keys offline, giving you full control and reducing the risk of hacks.

How to Sell Zcash Securely

To sell ZEC, follow these steps:

Transfer tokens to a reliable exchange or platform;

Choose a sell option, such as a market order for immediate execution or a limit order to set a preferred price;

Confirm the transaction;

Check your balance to make sure the transfer was successful.

It is also recommended to enable 2FA to avoid account hacking.

Conclusion

ZEC remains one of the most popular cryptocurrencies with an increased focus on privacy. It has a strong ecosystem and an expansion of scale in the cryptocurrency market. At the moment, the demand for Zcash is naturally growing due to a combination of flexibility and increased security, which makes it an ideal option for those who need anonymity and the ability to regulate its parameters.